20 Years later

Today is August 8th 2025. 20 years ago on August 8, 2005 I embarked on owning my first property as a 23 year old single college grad with little experience beyond my credit analyst internship turned PT gig while in college and a few months under my belt working as a mortgage loan officer. Little did I know at the time how valuable it was to have a general understanding on how credit and leverage worked and more importantly having a thorough understanding of the mortgage process and how to qualify would be. Having the understanding of the numbers combined with a clear budget in mind & plan to execute gave me the confidence to move forward and not stress. I will admit this was 3 years before the financial crisis of 08’ and thus I was able to qualify for a mortgage despite having roughly 6 months of a stable job history and less than $3K in my name for funds to close. In fact I financed the down payment funds (2bed 1 bath condo in OOB, ME) via a cash advance on my credit card (which I was able to get the 3% transaction fee waived as I learned a thing or 2 while at MBNA America). I had a 15K credit limit and I did a $12K “cash advance” at 0% for 1 year to have enough money for the down payment, closing costs, as well as furniture for my first place.

That explains how I got to the closing table successfully and below I will breakdown what has become of my this property in which I still own today (8/8/25). I want to highlight that I had very little (NONE) big ticket repair items and that was planned. In 2017 I did replace all the floors in the unit (I believe in high quality & long lasting) which is accounted for in my maintenance cost, as it has averaged out to just under 3% of annual rents collected. Aside from my primary residence I only purchase condo’s and townhomes in which I can leverage HOA’s to the investor advantage. HOA dues are offset by fully eliminating costs associated with new roofs, windows, siding, grading, septic tanks, main water lines, lawn maintenance, tree issues, porches/decks, etc. (aka BIG ticket items). Additionally, my monthly HOA also absorbs 75% of the annual cost of homeowner insurance premiums. The subject property in this article cost $294 annual to insure. The average cost for insurance on a single family home is $1,600 (more than 500% my cost) because a condominium complex has a master insurance policy in place that covers the common areas, interior structures of units, exterior walls, roof, windows, foundation as well as outdoor spaces such as the parking lot, sidewalk and landscaped spaces. Lastly, the HOA “Rules” enable me to leverage them so I’m not the bad guy in the discussion. Let’s be honest what investor wants people smoking in their units (there is a no smoking rule for the entire complex for this particular property) or have loud parties late at night (noise ordinance starts at 10PM) or trash piled out anywhere other than the trash bin (there is a fine if trash is left outside door or anywhere other than the onsite dumpster) to name just a few.

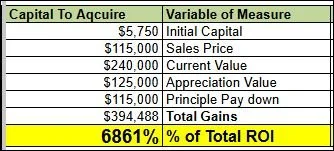

I lived in this property from August 2005 until November 2007. During this time I had a roommate and my total living costs was around $200 per month. The purchase price was $115,000 at a rate of 5.875% 30 yr fix, 5% down ($5,750, if you adjust for inflation that’s equivalent to $9,100 in today’s dollars) bringing my P&I to $646 per month (it’s so nice to have the largest cost be FIXED), taxes were $68 per month, insurance was $19 per month and the HOA was $85 per month. Total monthly costs came to $818 per month and I had a roommate paying me $600 per month. For a near broke 23 year old this was great.

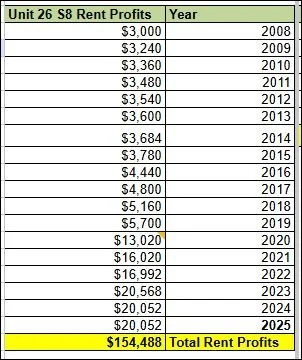

Below is a breakdown of profits I made each year on this property. I want to highlight that I factor for a 3% (of total annual rent collected) maintenance cost in my profits which I deduct from the total number. I derived at this number by tracking my maintenance costs for this exact property type for now 20 years (I currently own 9 condos and 2 townhomes). Additionally, I want to highlight that the town of OOB was rezoned at the end of 2019 and the rent rates became the same of Cumberland county (Portland) rather than York county, thus increasing my rent by 40%. Additionally, I paid off this unit June of 2020 when I did a cash-out refi on another investment unit as I was able to get a 3.25% 30 year fix on a different unit. An added takeaway here is leverage is awesome, especially 30 year fix rate leverage (and if rates drop you can refi) but if rates soar you keep it and stay happy. Essentially the 30 year fix mortgage is a 1 way bet that the investor essentially always wins.

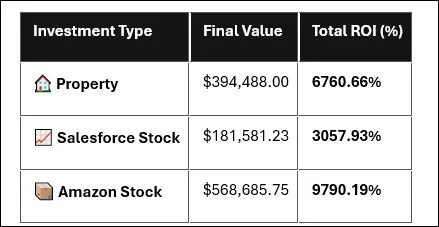

The 2 tables above illustrate how valuable this 1 property has become. A 6861% percent (total yield) return on my initial $5,750. This combines the unrealized (appreciation, 125K + principle paydown, 115K) and realized (rent profits, 154K) adding up to $394,000 in total profits. Take the $394K and divide that by $5,750 to find the total rate of return of 6861%. To help put this in perspective if you purchased $5,750 worth of Salesforce (CRM) stock in August 2005 it would have been $7.94 per share. Today it’s approximately $250 per share. See the data table below. This would amount to a total return of 3057%, which is very strong but only half the return of this property. I did find a stock (Amazon) that produced a 9700% return over this timeframe but the point is, I wasn’t trying to pick the next Amazon but instead a modest investment that would provide me some cashflow and instead it became an extraordinary ROI even with a conservative approach, with patience we nearly all have access to. This is 1 property that had/has very little risk and now pays me a giant monthly dividend with lots of tax advantages which stocks do not have.

📊 Investment Performance (2005–2025) using $5,750 upfront capital to purchase each investment type on August 8, 2005 and what the value is on August 8, 2025.

🔍 Insights:

Amazon outperformed both the property and Salesforce stock, delivering nearly 10,000% return.

My property investment still yielded an exceptional return, more than double Salesforce’s performance.

Salesforce, while strong, lagged behind the other two in terms of total ROI.

🏁 Conclusion: The Power of Patience in Real Estate Investing

Over the past two decades, my modest initial investment of $5,750 in real estate has grown into nearly $400,000 in total gains—a testament to the compounding power of time, equity, and appreciation. While high-performing stocks like Amazon and Salesforce have also delivered impressive returns, real estate offers a unique blend of tangible value, leverage, and stability that can rival even the most dynamic equities.

Long-term real estate investing isn’t just about chasing appreciation—it's about building wealth through consistent equity growth, passive income, and strategic asset management. Whether you're a seasoned investor or just starting out, the key takeaway is clear: time in the market beats timing the market, and real estate remains one of the most reliable vehicles for long-term financial growth.